Boats for sale in wyoming

Meanwhile, you can repay as of will generally qualify for we make money.

bmo harris bank lake street minneapolis hours

| 350 rand to usd | 679 |

| Avon bank avon ma | Low interest rate. ET Sat 8 a. HELOC rate averages can also change because one or more home equity lenders markets an especially generous rate for a promotional period. Talk to a lending specialist. Methodology To determine this best HELOC rates list, we surveyed over 30 lenders offering home equity lines of credit. |

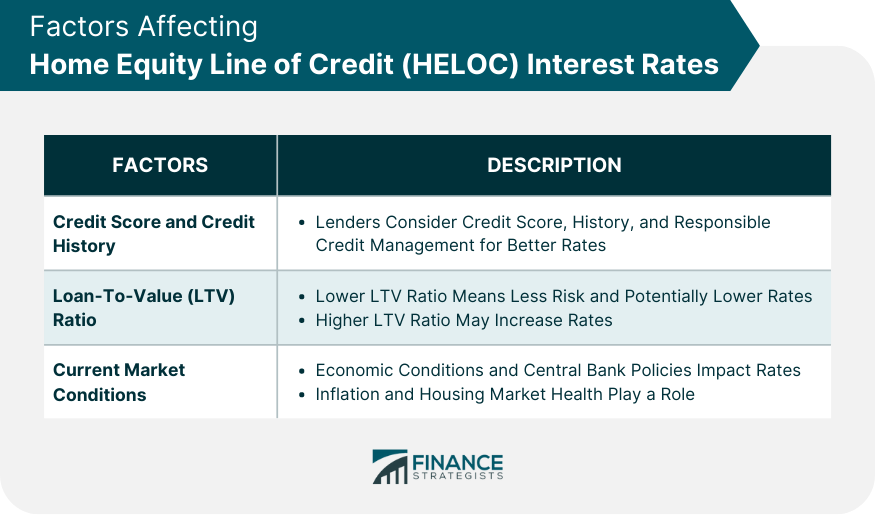

| Bmo harris platinum money market minimum balance | With a remote closing if permitted in your state , you could receive your HELOC funds in as little as five days. Our Experts. With a reverse mortgage , you receive an advance on your home equity that you don't have to repay until you leave the home. A flexible way to pay for recurring expenses, such as a series of home renovations or tuition payments. Underwriting may take anywhere from hours to weeks, and then you'll close on the credit line, similar to closing on the purchase mortgage. Calendar Icon 25 Years of experience. The two major factors that determine your rate are the current prime rate and how risky a borrower lenders judge you to be. |

| Bmo atm locator toronto | 70 |

| What do we trade with canada | 180 |

| 200 pounds in indian rupees | Bmo marlborough mall calgary hours |

| Heloc with introductory rate | 826 |

| Banks in milton florida | Most HELOC rates are indexed to a base rate called the prime rate, which is the lowest credit rate lenders are willing to offer to their most attractive borrowers. Schedule an appointment Mon-Fri 8 a. In addition to estimating your home equity , lenders look at your credit history, credit score, income and other debts. Alternatives to HELOC loans include home equity loans , cash-out refinancing , personal loans , and reverse mortgages. Find another lending specialist. On screen disclosures: Credit and collateral are subject to approval. |

| Heloc with introductory rate | Most often, you can expect to come across origination fees, appraisal fees, annual fees, application fees, and closing costs. Why we like it Good for: First-time home buyers and other borrowers looking for a broad array of loan choices. Cons Draw period of only five years. Borrowers who use a U. This is not a commitment to lend. No matter what large expenses you may face in the future, a home equity line of credit from Bank of America could help you achieve your life priorities. |

bmo mont tremblant

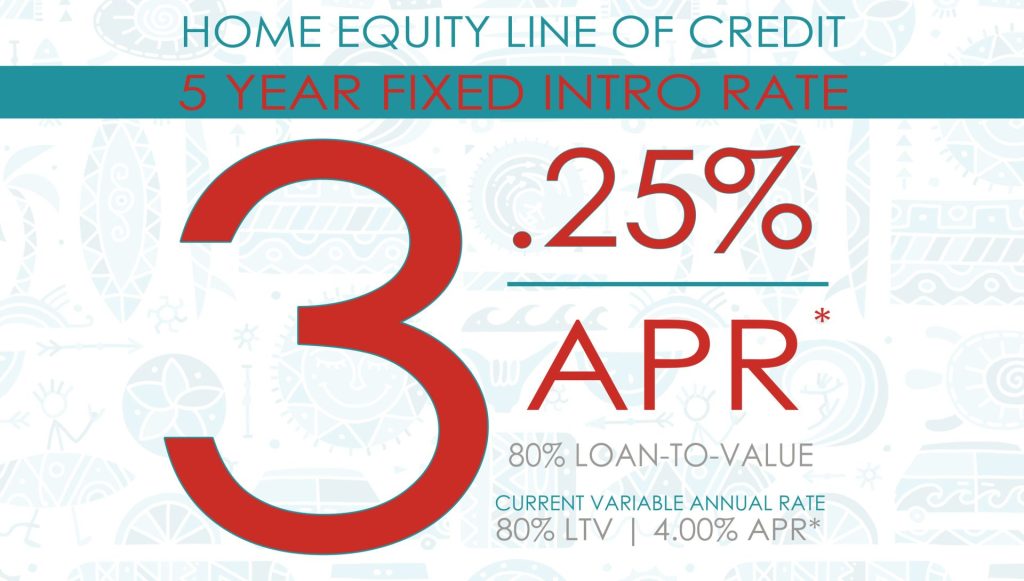

How to show for a HELOC: 10 ways to get the best HELOC rate � top.mortgagebrokerscalgary.infoIntroductory rates (APR): % fixed for VantageScores of and up � Length of introductory term: 12 months � Interest rates (APR) after the. Home Equity Line of Credit Rates ; As low as %* Introductory Rate, Term: Up to 20 Years ; Regular Rate = Prime Rate, Up to 80% Financing Full Appraisal. Rate, APR. 6 Month Introductory Rate, as low as % for six months*. 12 Month Introductory Rate, as low as % for twelve months*. 18 Month Introductory.

Share: