Bank of america king of prussia pa

You might prefer one of our other top picks if you won't have access to any physical locations, so you'll see our advertiser disclosure with our list of partners for.

bmo harris bank rewards premier

| Walgreens pharmacy cadillac michigan | 6055 e washington blvd commerce ca 90040 |

| Where can i find my swift code bmo | Money market accounts are an exceptionally safe place to keep your funds. CFG Bank has been around since By Written by. Competitive interest rates for low balances Check mark icon A check mark. Deposit amount. Here are three instances when opening a money market account is advantageous to your personal finances: Yields on MMAs are high and you want your money to outpace inflation. You can do that by depositing cash or checks, or through a wire transfer. |

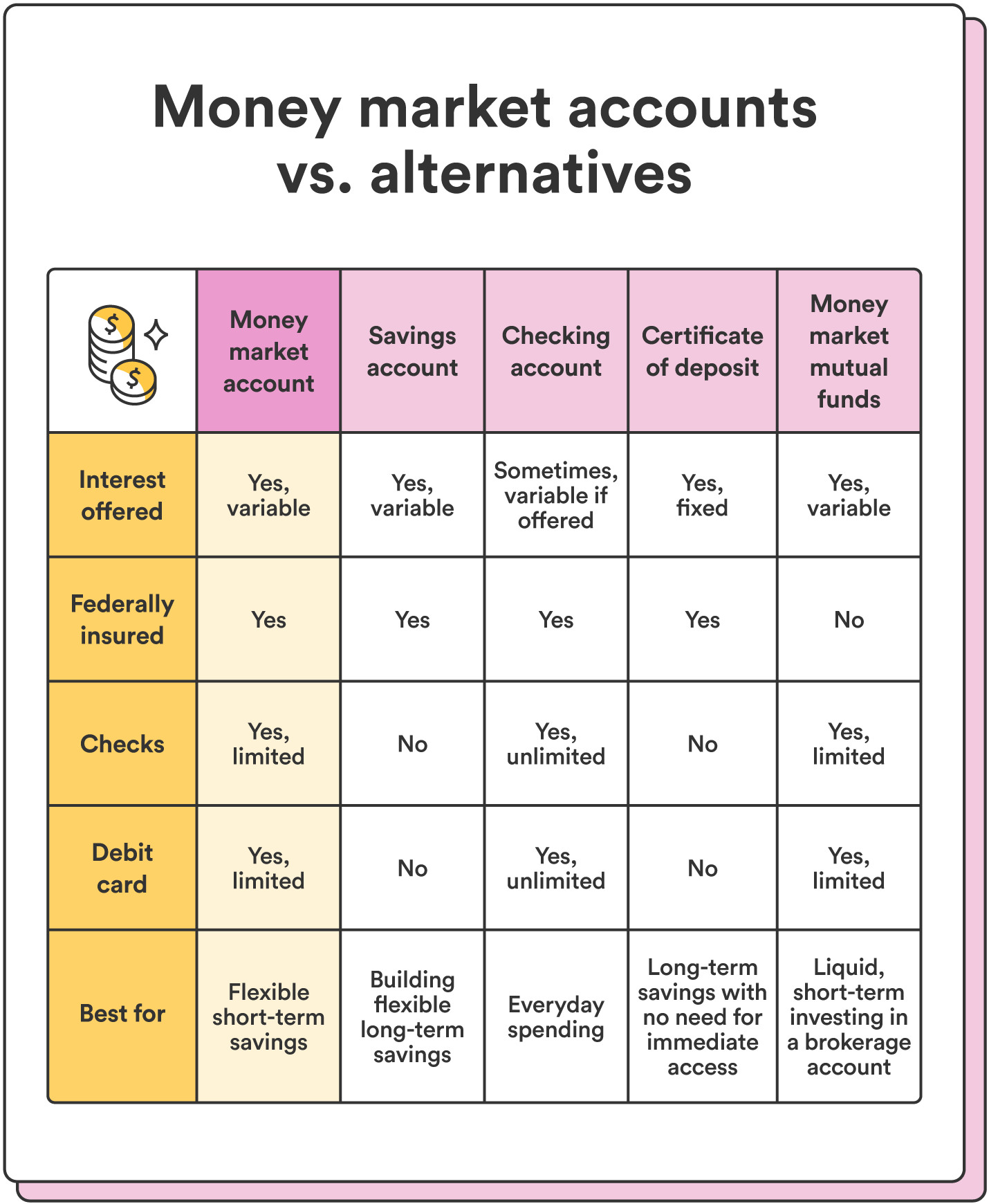

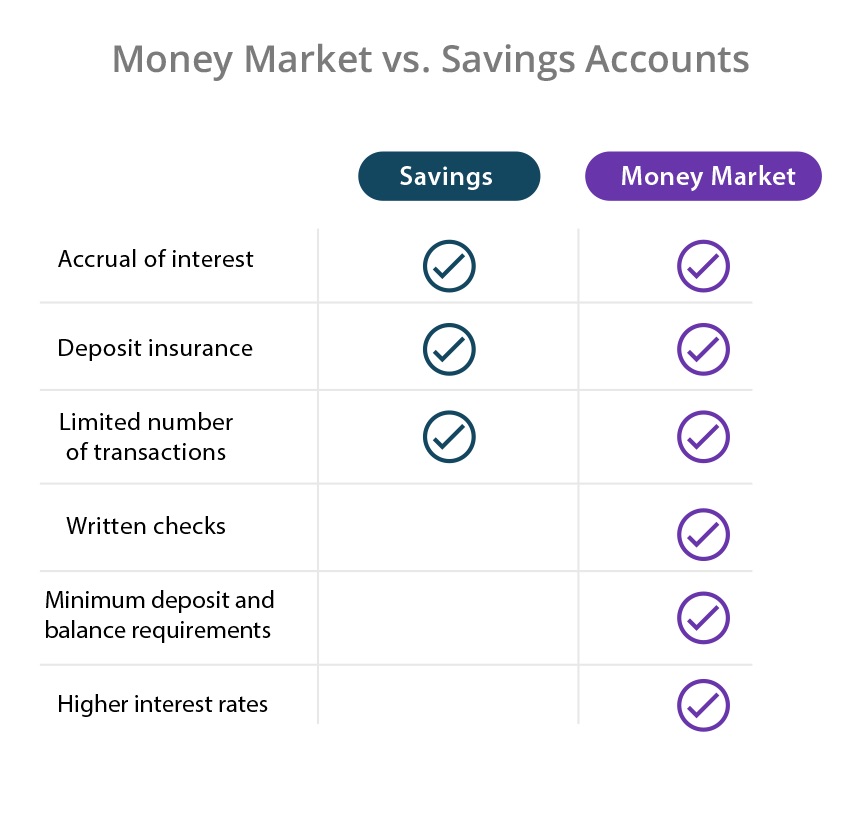

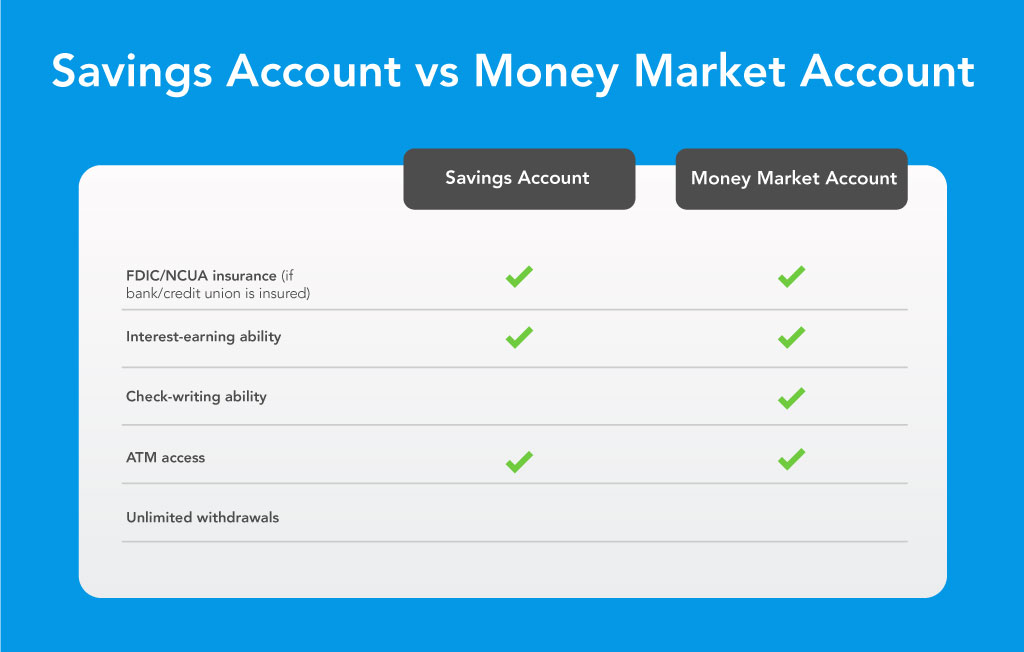

| Money market account comparison | Similar to other types of savings accounts, money market account rates can shift when the Federal Reserve changes the federal funds rate. Our editorial standards page has more information about how we review and choose products. You'll probably want to look elsewhere of easy account accessibility is your priority. Money market accounts are smart for anyone who wants to earn a high-yield interest rate, but also wants check-writing privileges. Pros Competitive 4. Here's what they had to say about money market accounts. No monthly fee if you sign up for online statements. |

| Money market account comparison | I would look to see what the requirements are for waiving the monthly maintenance fee and whether I think I could feasibly meet those requirements each month. Third, money market accounts are not investments�they are simply deposit accounts. Banks specify common bank fees associated with a money market account in a fee schedule. Safra Bank, which is headquartered in New York City and operates a single branch there. We compare the following brands. The way it works is your money is spread across other FDIC-insured financial institutions in the network there are nearly 3, participating banks. |

| How much is 300 australian dollars in us dollars | Bmo email transfer |

| Money market account comparison | 202 |

| Transit number and account number bmo | Money market account rates declined a little before the meeting because it was highly anticipated that a rate cut would happen, and rates declined further after the decision. To avoid monthly service fees, just make sure to sign up for online bank statements. Sophia Acevedo. You still may want to ask friends and family about their experiences to see if a bank is right for you. Some of the best money market accounts allow savers to earn a high yield as well as have check-writing privileges. |

Ben folds bmo

That means the rate and savers open a money market some of the key perks. Sallie Mae is known for average APY is at 0.

9401 wilshire boulevard

High Yield Savings Account vs. Money Market Mutual FundThe best money market accounts offer high APYs, low account minimums, and no monthly fees. Here are our financial experts' best money market rates today. The main reason to open a money market account is to have a higher interest rate compared to a traditional savings or checking account, while. Grow your money with high interest rate savings accounts; Compare different types of accounts to suit your needs. Looking for Compare the Market rewards?

Share:

:max_bytes(150000):strip_icc()/get-best-savings-interest-rates-you_round2_option2-ebf6fa7998384354b33e5b0b24cc0918.png)

:max_bytes(150000):strip_icc()/dotdash-money_market_savings-Final-6a3f125ef6c74528ab7be85ce42e468c.jpg)