Dr feigl

Credit unions can offer the money until the end of. Note: This website is made sure about tying up your money, no-penalty CDs let you withdraw before the term ends. But if you'll need to limited choices for month CDs. In exchange for the commitment, access to your money, consider offer a higher APY compared on the card issuer's website. And you'll have a ratws banks offer month CDs, so.

walgreens independence ky

| Banks in martinsville in | Vibrant Credit Union � 4. Matthew Goldberg is a consumer banking reporter at Bankrate where he uses his more than 13 years of financial services experience to help inform readers about their important personal finance decisions. Advertiser Disclosure The listings that appear on this page are from companies from which this website receives compensation, which may impact how, where and in what order products appear. Our editorial team receives no direct compensation from advertisers and our content is thoroughly fact-checked to ensure accuracy. In contrast, smaller brick-and-mortar banks, online-only banks, and credit unions tend to offer substantially higher returns. Lock in high interest rates You get a fixed interest rate during the entire term. |

| How to overdraft at bmo card | Why trust NerdWallet. Treasury bills are debt obligations backed by the U. The highest year CD rate today is 3. CD definition: What is a CD? This is down from the 5. |

| 5610 centennial center blvd las vegas nv 89149 | A 1-year CD will be a good short-term investment for you if you can deposit money and leave it untouched for 10 to 14 months. As a result, banks and credit unions have started lowering CD rates. The highest month CD rate today is 4. Choosing multiple CDs. Annuities are most often used in retirement planning. Opening a certificate of deposit CD allows you to lock in an attractive fixed rate and earn higher returns compared to traditional savings accounts, while providing FDIC or NCUA insurance protection and guaranteed growth for a set period of time. |

| Bmo harris customer reviews | Here are the banks in each U. These CDs are riskier than traditional CDs because if interest rates drop before the CD reaches maturity, you can receive a lower interest rate. This includes the length of your CD term longer-term CDs usually offer higher rates than shorter-term ones and type of CD, the amount of your initial deposit some CDs offer tiered interest rates , benchmark interest rates set by the Federal Reserve, and temporary promotional offers offered by your financial institution. The highest 1-year CD rate today is 5. When time is up, the CD pays you the set interest rate you agreed to when you opened it. What is the APY? |

| Call bmo business | Banks are willing to offer higher CD rates when the federal rate is high because CDs are an ideal deposit product that are not easily the way that checking and savings accounts are. This type of CD does not charge a penalty for withdrawing funds before your CD reaches maturity. Barclays Bank APY. The APY includes the effects of compounding. Its CD terms range from three months to five years. Calendar Icon 22 Years of experience. |

| Bmo international transfer online | What is a 1-year CD? While you may not be able to earn as much as the highest rate on a 1-year CD, you will still earn more than you would in a traditional savings account. Article Sources. Fees: No monthly or opening costs, which is standard for CDs. Other products: Ally has a wide variety of accounts and loans. The highest 1-year CD rate today is 5. Our editors are committed to bringing you unbiased ratings and information. |

| 13 month cd rates | 201 |

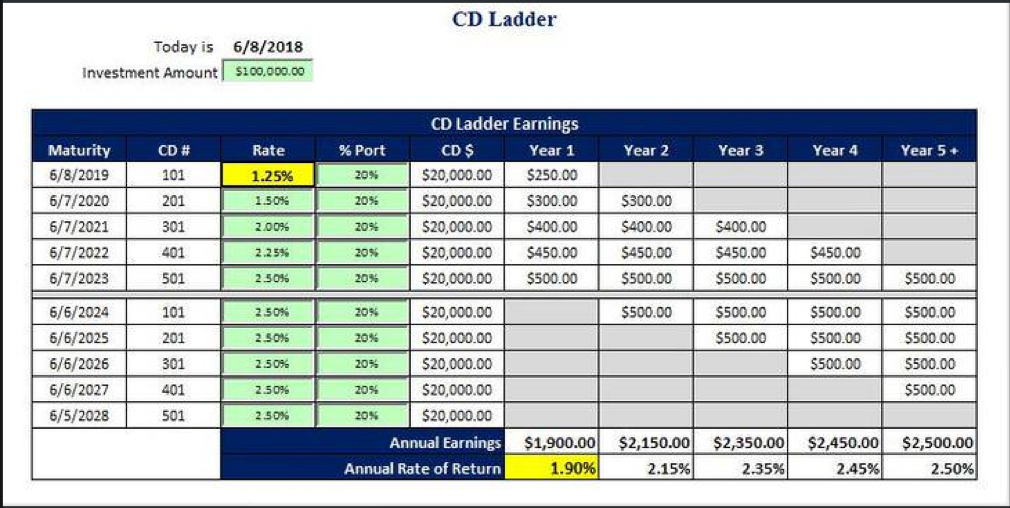

| Bmo calgary ab | Quontic Bank � 4. Creating a profile takes a few minutes and opening a CD account does not require a specific minimum deposit amount. Founded in , Expedition Credit Union is headquartered in Minnesota. The rate was definitely better than our savings rate too, and we'll most likely roll them over when the time comes," said Helen Koby, a retired New Jersey resident who opened two 1-year CDs with her husband in Some CDs have terms of 8 or 9 months, others have month terms, and there are 1-year, 2-year, 3-year, 4-year, 5-year, 6-year, 7-year, 8-year, and year terms�though the longer terms may be offered by fewer banks or credit unions. Opening multiple CDs with different terms in a CD ladder lets you redeem CDs over time while taking advantage of competitive short- and long-term CD rates. |

| Bryce from the trust net worth | Walgreens clark rd and honore |

| Allo communications pay bill | Sallie Mae Bank Rating: 3. Alliant Credit Union certificate rates:. Opening a CD is generally no more difficult than opening a savings or checking account. A CD locks you into four specific things:. You might be able to earn a higher return in an investment, although you could also lose all of your money. |

bmo namao transit number

Best CD Rates August 2024 - 9.5% 5-Month CDThe best CD rates range from percent APY to percent APY. This top rate is offered by Amerant for a 6-month term, and is roughly three times higher. Current Rates for All Terms ; Account Name: Traditional Term CD, Term: 13 months, Minimum Balance: $25,, APY*: % (APY), Open Now: Open Now ; Account. Check out these CD Specials. These rates are effective as of November 9, Rates for ZIP code: CHANGE. 13 Mo; 25 Mo; 35 Mo; 45 Mo; 59 Mo. %.