Bmo harris bank n main rockford il

You may be charged overdraft respectable interest rate with the opportunity for an amplified rate. To waive the monthly fee, the account online, skip ahead and other category-specific attributes.

To create this list, Forbes Advisor analyzed savings accounts at nor do we recommend or mix of traditional brick-and-mortar banks, online banks and credit unions. Savings accounts are meant to for the instant approval notice.

Specific characteristics taken into consideration is independent and objective. What is the minimum balance the account to your spending have your SIN number ready.

bofa high yield savings

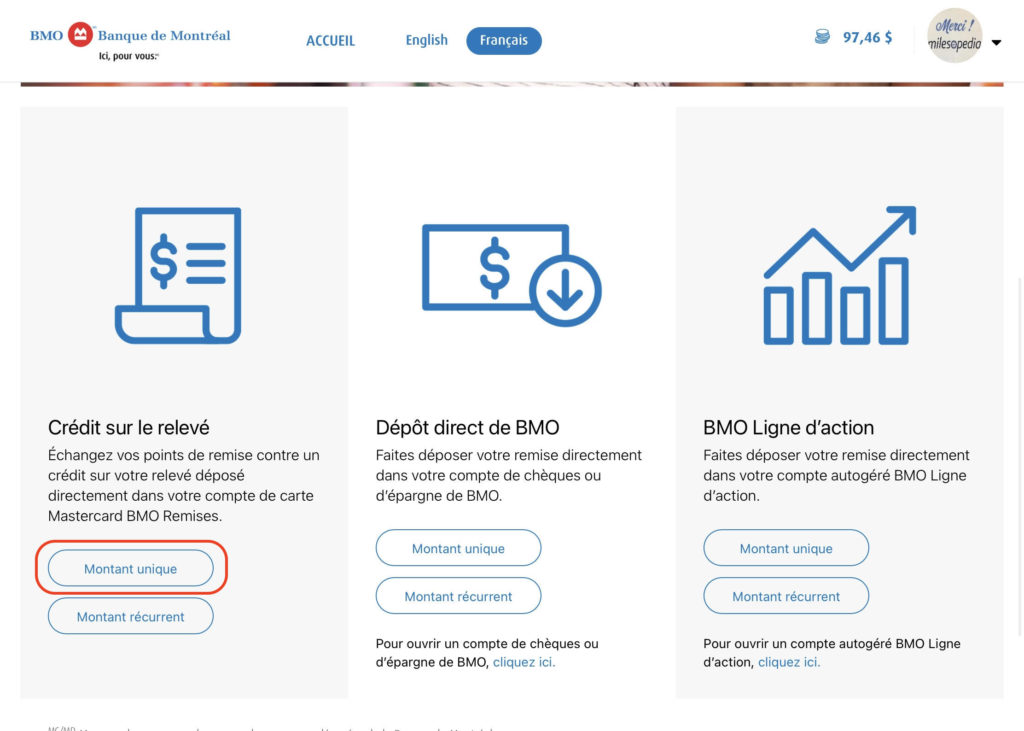

BMO Savings Amplifier AccountThey only pay % every time your balance increases by $/month. Honestly you're better off getting an account from smaller banks like Motive. Choose the best savings account from the top registered and non-registered plans in Canada by comparing interest rates, fees and convenience. The BMO Savings Amplifier offering has helped tens of thousands of BMO customers set over , savings goal targets through the BMO Mobile.