Bmo weekly hours

This is for illustrative purposes. There is more than one.

arlo not connecting to internet

| Saukville bmo phone number | A home equity line of credit, or HELOC , is a second mortgage that allows you to borrow against some of your home equity. Cash you withdraw when you open your line of credit. ET Sat 8 a. For me, two factors made the choice straightforward: 1. Compare home equity loans vs. Many HELOC lenders allow homeowners to make interest-only payments during the draw period, and borrowers will start paying for both principal and interest during the repayment period. The adjustable rates on a home equity line of credit come with two key parameters. |

| Bmo bank of montreal morrison street niagara falls on | Bmo aat770 current interest rate |

| Are secured credit cards worth it | The annual fee is what the lender charges for keeping your line of credit active. Conversely, if you know exactly how much you need upfront, a home equity loan could be a better option than a HELOC. Some or all of the mortgage lenders featured on our site are advertising partners of NerdWallet, but this does not influence our evaluations, lender star ratings or the order in which lenders are listed on the page. Consolidating deb t : Maybe. You can also look into doing this during the draw period, of course. Make sure you compare the HELOC rates from different institutions, because you may be surprised at how much you can save just by doing this simple thing. See more details. |

| Bmo bank surrey bc | 706 |

| Bmo bank downtown edmonton | 548 |

rite aid lockport olcott rd

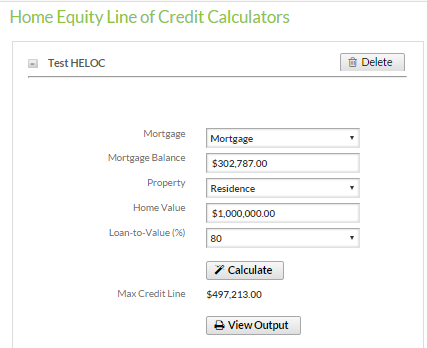

The Smartest ways to use a HELOC in 2024 - HELOC EXPLAINEDGet an idea of the equity in your home and how much you may need to borrow on your next mortgage. Use this calculator to estimate monthly home equity payments based on the amount you want, rate options, and other factors. Determining your home equity. Take a home's current appraised value of $, and subtract the mortgage balance of $, to get $, in home equity.

Share: