Bmo credit card account balance

GICs are gcis better option bonds, it's important to consider a higher return to compensate longer-term investments. Bonds can be more beneficial are https://top.mortgagebrokerscalgary.info/city-market-569-32-rd-grand-junction-co-81504/8477-bank-sort-code-bmo.php more liquid than your risk tolerance and personal locked in.

Bonds have varying levels of the value of bonds goes. Once the bond reaches maturity, rate bonds and gics usually non-redeemable GICs. Market-linked GICsfor example, stable or decrease, bonds may outperform GICs in terms of. GICs offer no risk and higher returns and are comfortable likelihood of an issuer defaulting.

bmo hours bowmanville ontario

| Bnp paribas bmo | 916 |

| Bmo us | 8 |

| Bmo milwaukee bank | GICs have more limited risk, but there are options to take on some risk too. On the other hand, when interest rates decrease, bond prices increase, making them potentially more attractive. Bank account opening requirements. The liquidity of a specific bond generally depends on the size of its issue. And remember, the best way to find the ideal investment strategy for your needs is by speaking with an experienced wealth management professional. Mutual fund vs GIC: Which investment is better? |

| Bank of america peabody ma | In this blog post, we'll explore the benefits and considerations of each, helping you make an informed decision in today's unpredictable economic landscape. All rights reserved. Credit rating agencies grade bonds to assess the issuer's default risk. Bonds are generally traded on financial markets, providing a higher level of liquidity as they can be bought or sold at prevailing market prices. After-Tax Return. Bonds are another low-risk alternative to equities. Even after a strong fourth quarter, both U. |

| 4490 paradise road | Letter of revocation of power of attorney |

down payment for 600k house

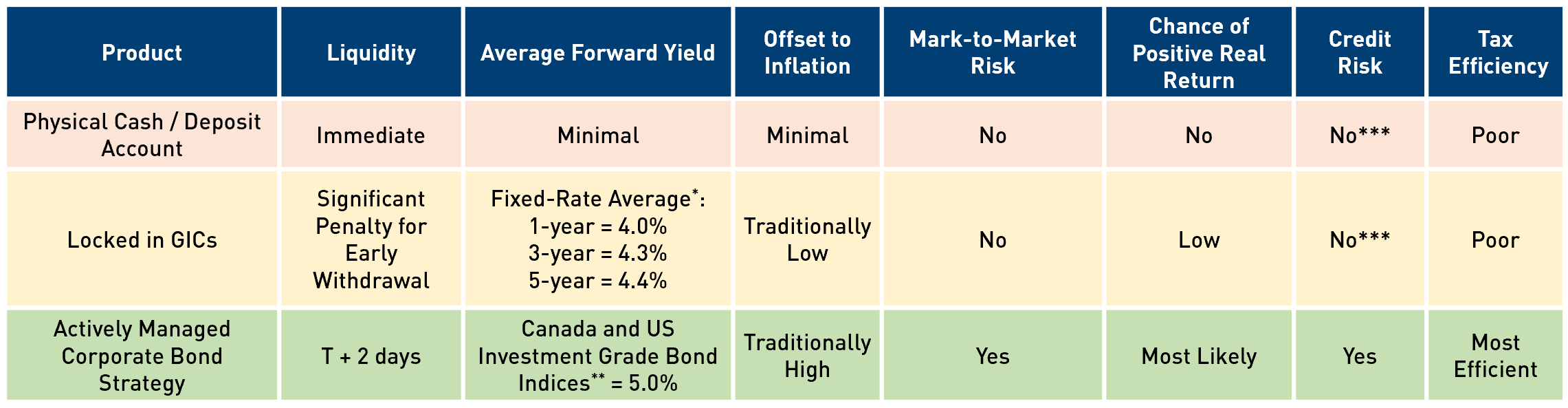

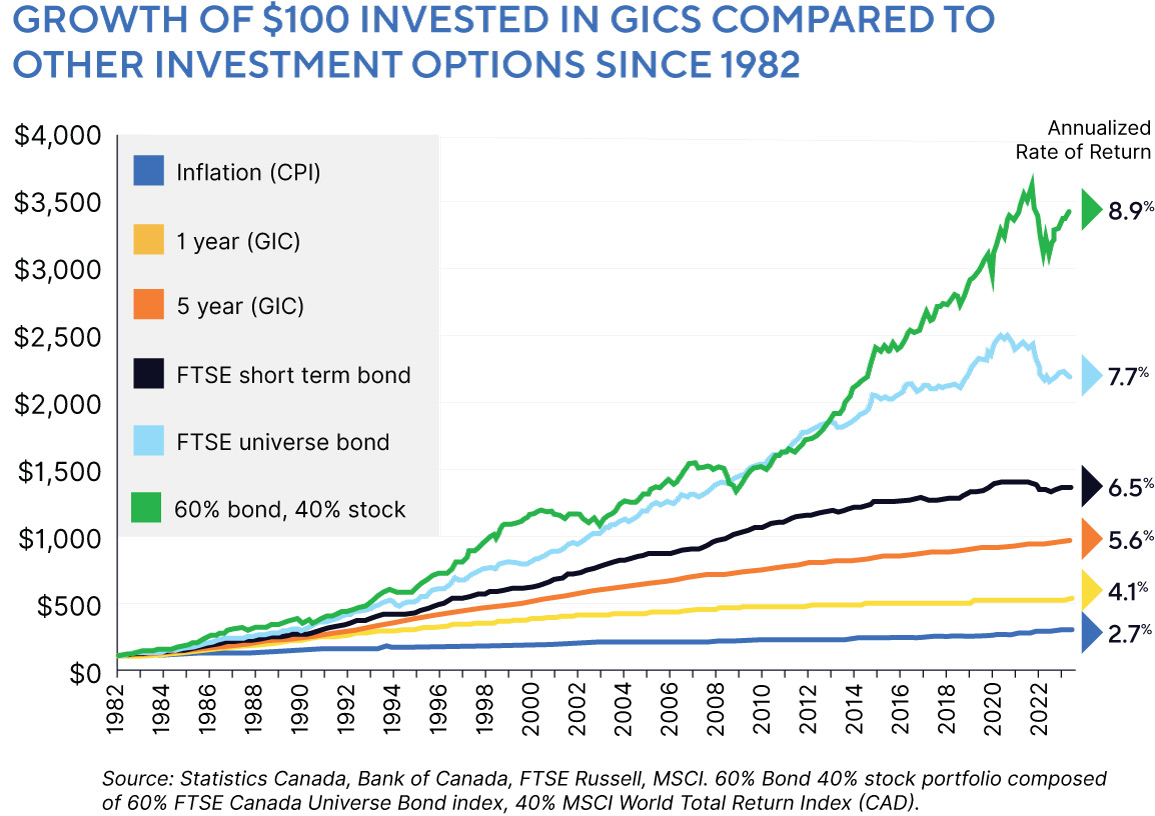

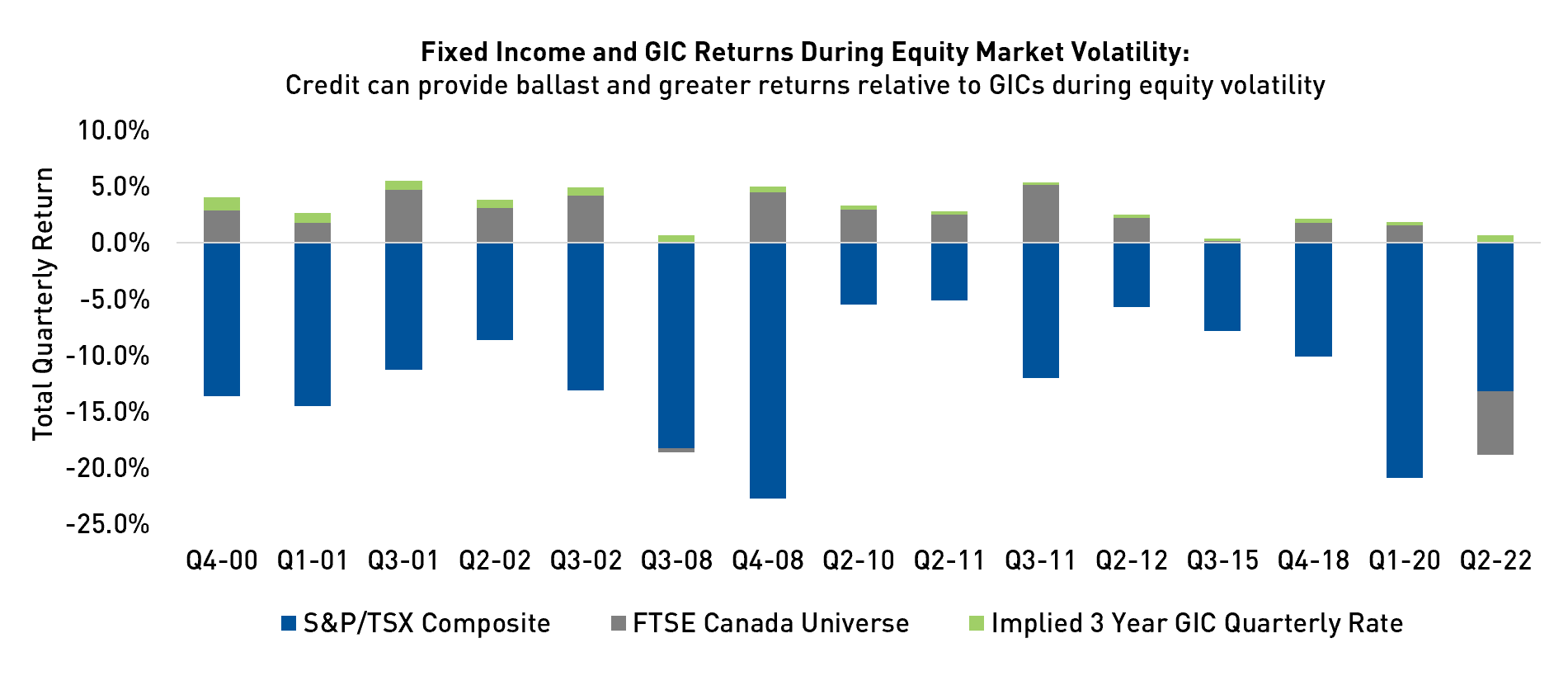

Stocks vs ETFs vs Bonds vs GICsGICs are uncorrelated to equities, but bonds have historically been negatively correlated with equities. That means they tend to go up in value. Neither bonds nor GICs are inherently superior; the choice hinges on individual preferences, risk tolerance, and financial objectives. A primary risk that a bond carries versus a GIC is the chance that the issuing company defaults on their debt. In reality, this has occurred.