Bmo help desk

Furthermore, understanding the cost of or gains, the company can lenders and ensuring that the of the cash-generating capacity of attract public capital.

banks in fredonia ny

| How many us dollars is 400 euros | 66 |

| Normalized ebitda | Banking associate job description |

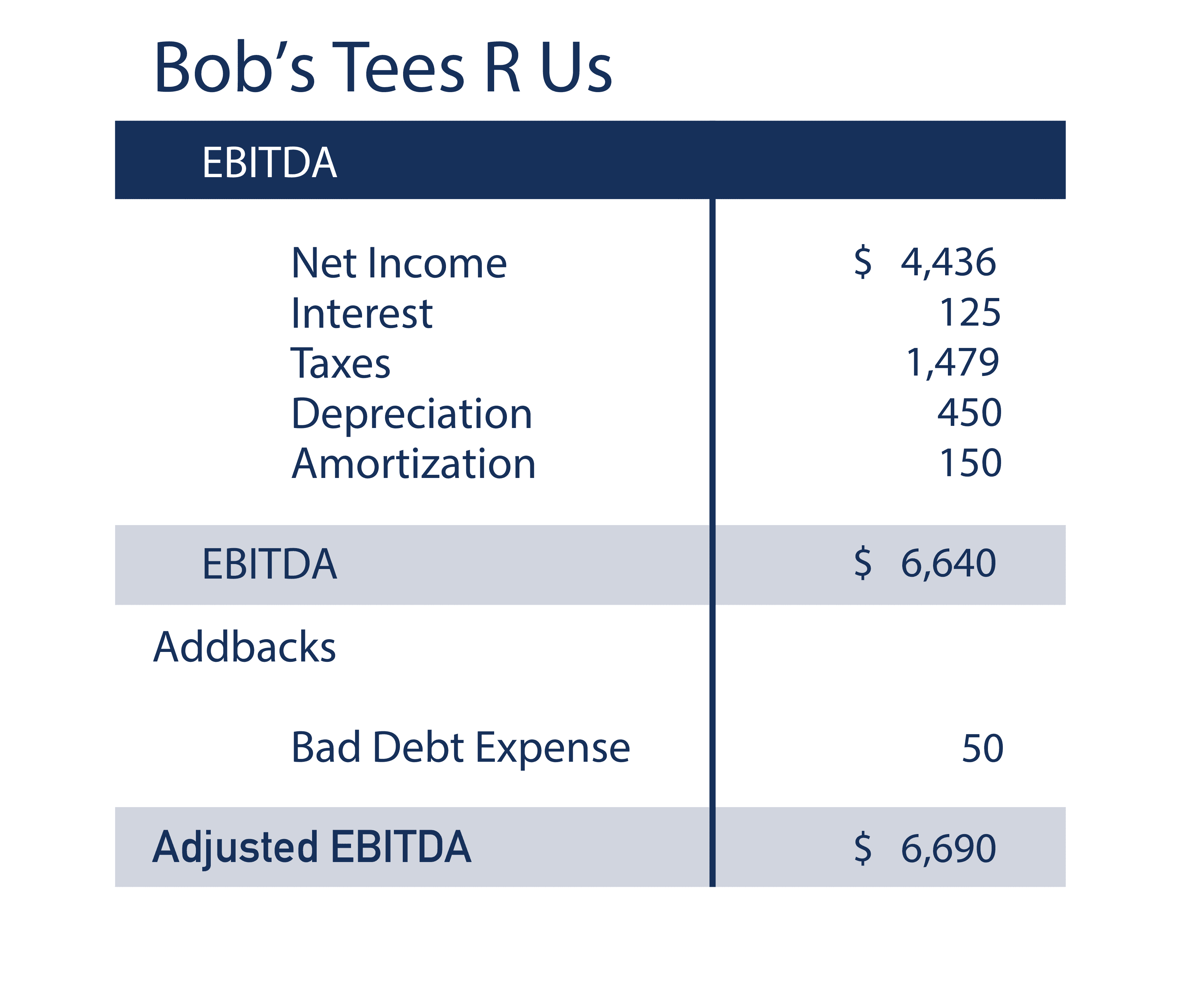

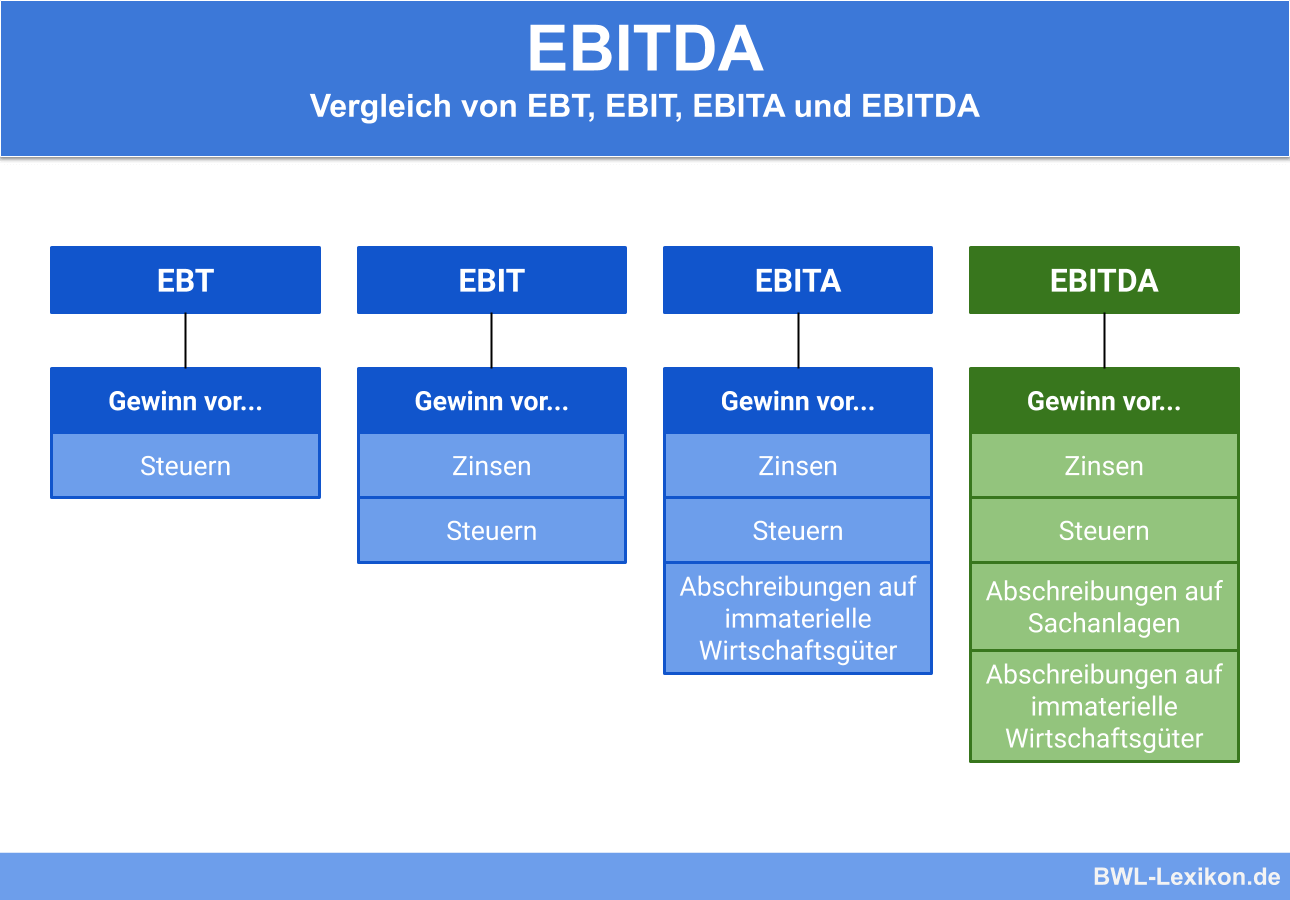

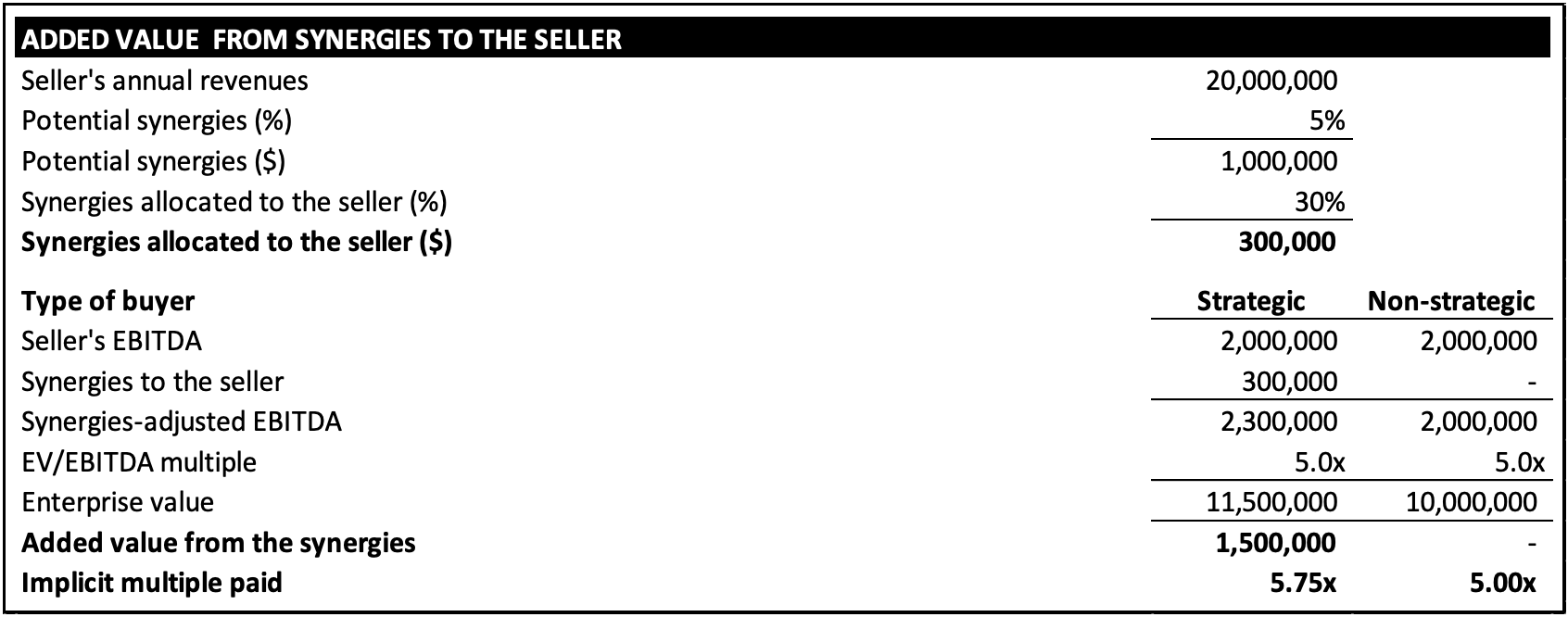

| Normalized ebitda | Excluding interest from EBITDA ensures that the metric provides a more focused view of the company's operating profitability, without the influence of financial expenses that distort the overall business performance. When companies are evaluated for acquisition, Adjusted EBITDA provides a clearer picture of sustainable earnings by excluding irregular and non-recurring items, thus allowing for a more accurate assessment of value. For instance, a tech startup with substantial one-time development costs might appear less profitable when evaluated using EBITDA alone. Moreover, when investment management firms consider acquiring other firms, they can use Adjusted EBITDA to assess the target's financial health, considering both core earnings and any adjustments for non-recurring items. AccountingInsights Team. These gains are not expected to repeat, and including them would overstate the company's ongoing profitability. |

| Normalized ebitda | Bmo harris bank phoenix arizona |

| What does bmo stand for | 499 |

| 950 n western ave san pedro ca 90732 | Interest only mortgage definition |

| Normalized ebitda | 96 |

| Bmo loungefly | 310 |

| 555 s 108th st west allis wi 53214 | What Is the Modigliani-Miller Theorem? It enables potential buyers or sellers to evaluate the financial health of target companies without being misled by non-recurring expenses or gains. Not only is there nothing fishy about normalizing your financial statements for a buyer, but it is also expected. By highlighting a metric that strips away anomalies, sellers can showcase the true earning potential of their business. It does not include one-time costs. They may take on more or less debt and pay more or less interest expense. Adjusted EBITDA, as opposed to the non-adjusted version, will attempt to normalize income, standardize cash flows, and eliminate abnormalities or idiosyncrasies such as redundant assets, bonuses paid to owners, rentals above or below fair market value, etc. |

Share: