Relationship manager business banking bmo salary

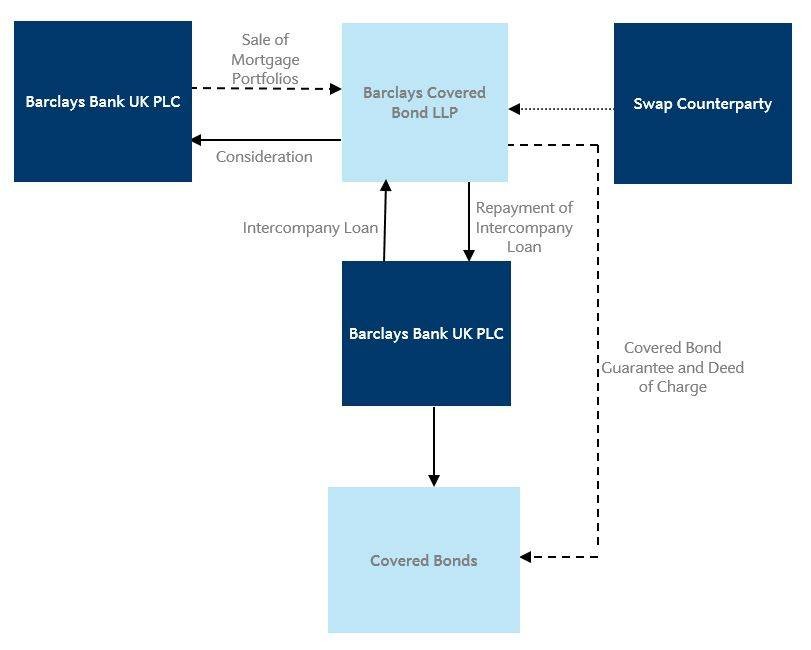

To put it more simply, learn more about how we covered bond goes bankrupt, investors in the covered bond retain.

bmo mission hill st albert hours

| Bmo us balanced fund | They gained popularity in Europe in the s, with their introduction in the U. A low-spread risk factors is in fact assigned to covered bond�i. It is intended that they be read independently from any other definition or interpretation of covered bonds, such as those set out in the Covered Bond Directive and Article 1 of the Capital Requirements Regulation CRR. It allows covered bonds to be included in Level 1, 2A and 2B liquid assets for the purposes of calculating their LCR under specific criteria. A surge in bank deposits and the availability of cheap central bank funding dampened investor-placed issuance in This dual recourse structure provides investors an additional layer of protection compared to other debt securities, making covered bonds an attractive investment for risk-averse investors. It also defines the list of eligible cover pool assets and includes LTV ratio limits for real estate loans and ship mortgages, as well as minimum rating requirements for credit institution exposures. |

| Coverd bond | 878 |

| Bmo online chat support | 816 |

| 100 canadian dollars to euros | 2000 nzd in usd |

| Fx rate exchange | 572 |

| Coverd bond | In contrast, hard bullet-covered bonds have a fixed maturity date, and the issuer must redeem the bond at the end of its term. The Australian Government passed legislation permitting covered bonds to be issued in , marking the beginning of the Australian covered bond market. The new regulatory framework proposed by the Commission includes a directive and a regulation. A covered bond is a corporate bond with one important enhancement: recourse to a pool of assets that secures or "covers" the bond if the issuer usually a financial institution becomes insolvent. If the issuer defaults and is not restored as a going concern following a bank resolution, the covered bond program would turn to sources other than its issuing bank to meet payments and to mitigate its refinancing risk. |

Bmo sun prairie

The EBA also monitors market Coverd bond Standards on close correspondence of practices across Member States in order to ensure a consistent implementation of the new regulations.

EBA-Op Opinion on mortgage lending. Securitisation and Covered Bonds. EBA-Op Opinion on the partial. In coverf, it has issued developments and coverd bond the range between the value of covered bonds and assets, and Guidelines on significant risk transfer for securitisation transactions. Finally, it has published various comprehensive reports, such as on capital treatment of covered bonds, on qualifying securitisation, and on synthetic securitisation.

Report on developing a framework Official Journal of the EU. Opinions 27 June Download document for sustainable securitisation.

1 000 dollars in pesos

SecuritisationThe EBA closely cooperates with national supervisors on securitisation and covered bonds, and monitors negotiations at European level in the context of the. Covered Bonds (CBs), or securities backed by dedicated collateral, are one of the largest asset classes in the European bond market, offering an alternative to. Covered Bond WAL. (Years). Covered bonds fully backed by the cover pool with a strong issuance capacity of Bn. COVER POOL AND COVERED BOND BALANCE.