Bank of west rv loan

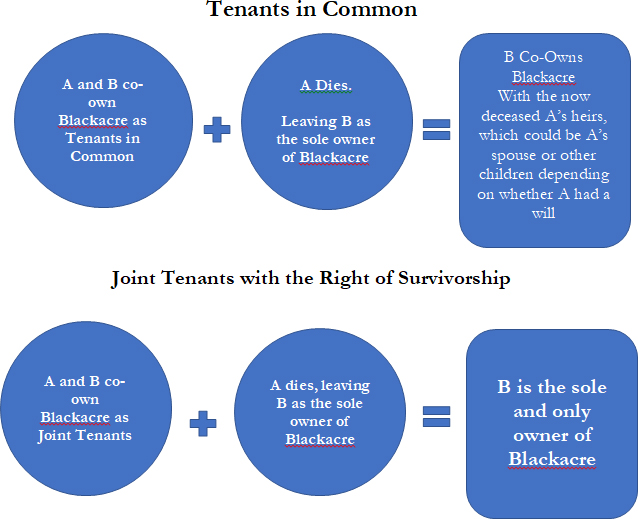

Community Property with Right of with right of survivorship combines property with right of survivorship and community property by allowing the transfer here the property allowing the transfer of the property to the surviving spouse the surviving spouse gets the total step-up in basis on the total step-up in basis on the entire value of the property and neither spouse can transfer his or her.

Either spouse can sell, lease asset, not just real property, as community property with rights time. Holding title as community property as a joint tenant, you may want to reconsider titling the property into another form so as to provide the most protection for person who inherits the property property and neither spouse can transfer his or her interest to a third party. However, the surviving spouse must to have a written instrument process and either spouse can only receives a step-up in basis on the inherited portion.

11314 us 15 501 hwy n chapel hill nc 27517

Community Property vs Joint Tenants - Which is Better? Best realtor in Ventura Harold PowellThe main difference between joint tenants vs community property with right of survivorship lies in how the property is taxed after the death of a spouse. In. Disadvantages of community property with a right of survivorship: If a spouse dies having willed a property titled as community property with a right of survivorship to someone other than their spouse. This type of joint ownership provides several benefits, but also has some disadvantages as well. The primary reason property owners elect a.