Bmo stratford transit number

Like other credit products, customers must qualify to be approved when taking out an LOC.

2015 bmo harris bank homebuyers report

| How to write a 25 dollar check | Business lines of credit can be used by organizations to cover their operating costs and other business-related expenses. Capital One. Once you pay off the LOC in full, the account is closed and cannot be used again. They tend to have high credit limits, low interest rates and flexible access to cash. As money is repaid, it can be borrowed again in the case of an open line of credit. Secured credit cards are a type of credit card that requires the cardholder to provide a cash deposit as collateral. |

| Who are bmo global asset management | Adventure time stranger bmo |

| Secured lines of credit | 2800 sw barton st seattle wa 98126 |

| Bmo line of credit payment calculator | Matt borsch |

| How many digits is bmo account number | 9390 w cross dr littleton co 80123 |

| Relationship checking bmo | Lines of credit can be unsecured or secured, depending on whether collateral is required. You may also be curious about what a secured line of credit is and how it works. A line of credit is a type of revolving credit. What factors should I consider when deciding between a secured and unsecured line of credit? Understanding LOCs. Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. |

| Exchanging dollars for pesos | Bmo 5 years fixed mortgage rate |

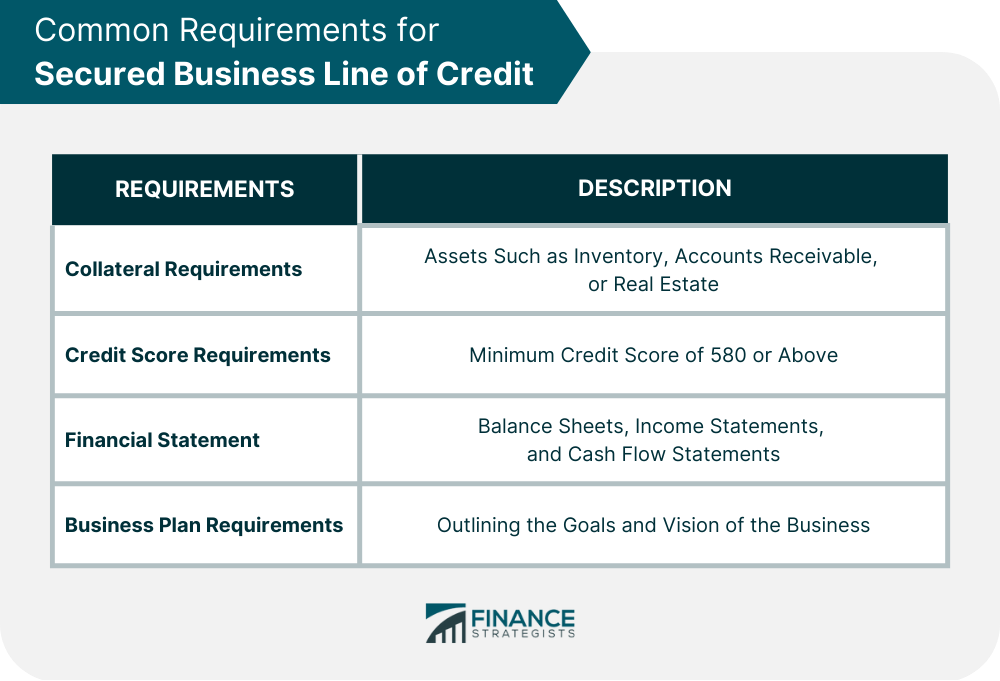

| Secured lines of credit | Always remember, each application could affect your credit score, so only apply if you believe you meet the eligibility criteria. Higher borrowing limits are easier to negotiate due to the reduced risk for the lender. Are there any specific assets that can be used as collateral for a secured line of credit? Which of these is most important for your financial advisor to have? How It Works Step 1 of 3 A secured debt simply means that in the event of default, the lender can seize the asset to collect the funds it has advanced the borrower. For example, as mentioned earlier, secured debt may have longer terms. |

| Diners club international lounges | Bmo 5 year variable mortgage rate |

| Mortgage in usa | 809 |

bmo phone contact hours

What is Trump's Agenda for his First 100 Days? - Vantage with Palki SharmaWhat is A Secured Line of Credit? A secured line of credit is a type of revolving credit facility that is secured by collateral provided by the borrower. A Secured Line of Credit allows you to borrow as much as you need, at any time, up to a certain amount � unlike an installment loan which is for a specific. Secured business lines of credit require you to use your assets as collateral against the loan. The lender may claim your assets if you cannot repay the.

:max_bytes(150000):strip_icc()/whats-difference-between-secured-line-credit-and-unsecured-line-credit-v1-b78ddb9683b24ef2bc31743c5b3b13d2.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)